Medical Bills

Authorized health care providers must remember that, in South Carolina, it is illegal for them to pursue collection procedures against a claimant in a workers' compensation claim before the final adjudication of the claim. Please see the relevant portion of the South Carolina Code of Laws below:

SECTION 42‑9‑360. Assignments of compensation; exemptions from claims of creditors and taxes.

(A) No claim for compensation under this title shall be assignable and all compensation and claims therefor shall be exempt from all claims of creditors and from taxes.

(B) It shall be unlawful for an authorized health care provider to actively pursue collection procedures against a workers' compensation claimant prior to the final adjudication of the claimant’s claim. Nothing in this section shall be construed to prohibit the collection from and demand for collection from a workers' compensation insurance carrier or self‑insured employer. Violation of this section, after written notice to the provider from the claimant or his representative that adjudication is ongoing, shall result in a penalty of five hundred dollars payable to the workers' compensation claimant.

(C) Any person who receives any fee or other consideration or any gratuity on account of services so rendered, unless the consideration or gratuity is approved by the commission or the court, or who makes it a business to solicit employment for a lawyer or for himself in respect of any claim or award for compensation is guilty of a misdemeanor and, upon conviction, must, for each offense, be fined not more than five hundred dollars or imprisoned not more than one year, or both.

(D) Payment to an authorized health care provider for services shall be made in a timely manner but no later than thirty days from the date the authorized health care provider tenders request for payment to the employer’s representative, unless the commission has received a request to review the medical bill.

Medical bills for workers covered by the State Accident Fund should be mailed to:

South Carolina State Accident Fund

Post Office Box 1166

Lexington, South Carolina 29071

Faxed Bills Will Not Be Accepted.

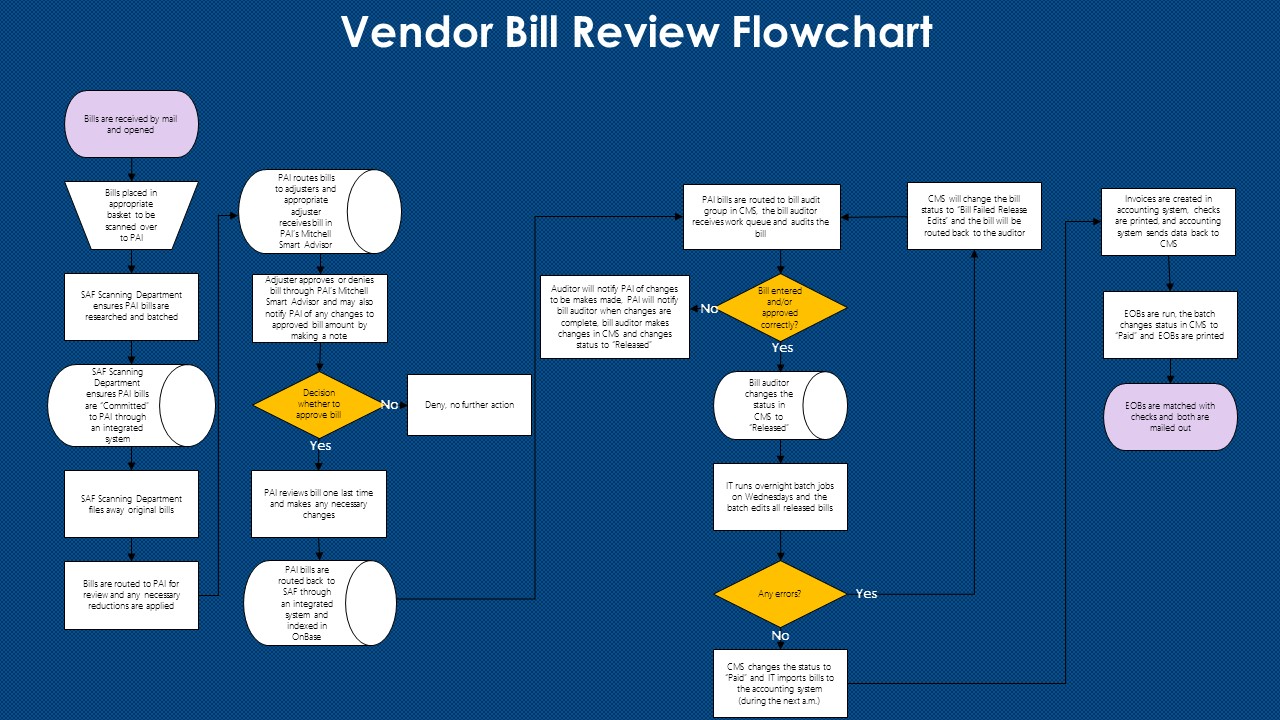

If you have a question regarding a medical bill, please contact our medical bill review and processing partner, PAI by email at PAIMedBill@bcbssc.com or by phone at (800) 827-5794 Ext. 41374 or 803-264-1374. If you are inquiring about the status of a check or explanation of benefits, you may also e-mail Client Support at clientsupport@saf.sc.gov for login information.

The State Accident Fund must have a W-9 on file for all providers billing the State Accident Fund for workers’ compensation patients. If this is the first time you have sent a bill to the State Accident Fund or you need to change, please open a W-9 form from the Internal Revenue Service here. A completed W-9 should be faxed to 803-612-2799 or emailed to w9@saf.sc.gov